How AI Trading Crushes Human Traders: 5 Key Lessons from WEEX's $1.8M Trading Hackathon

Main Takeaways

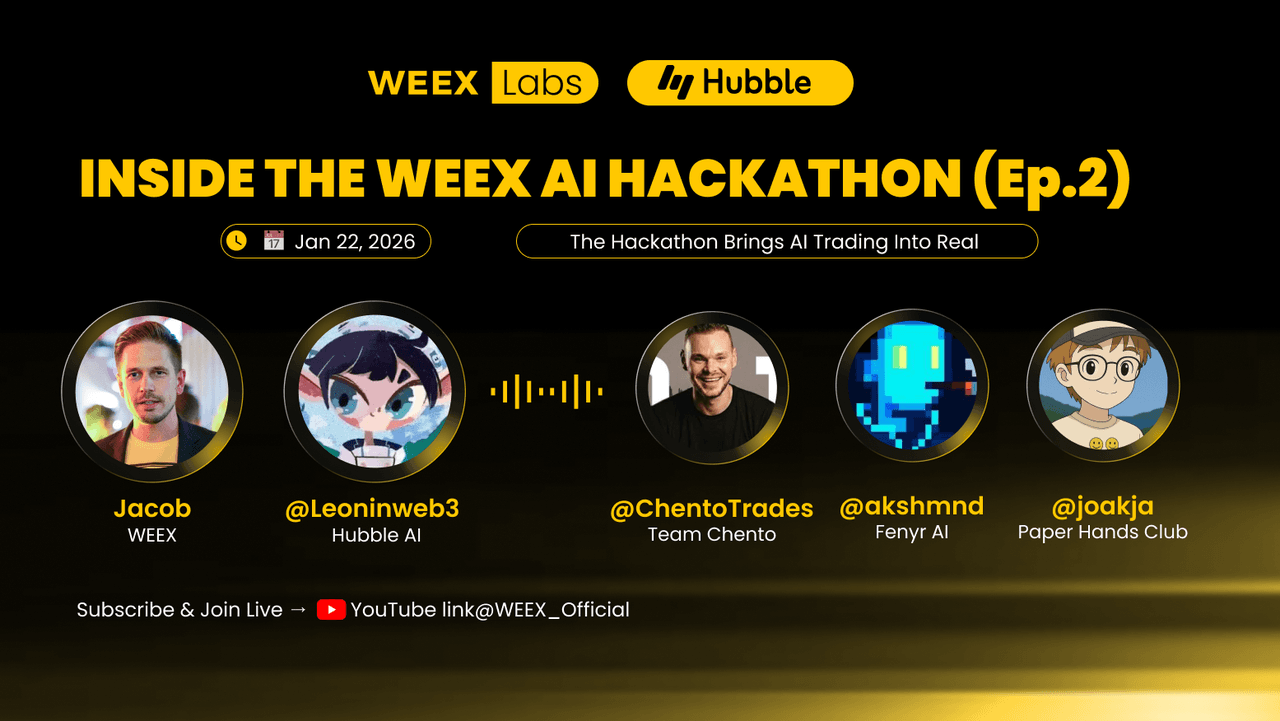

- On January 22, 2026, WEEX hosted a livestream AMA as part of WEEX's global AI trading hackathon AI Wars: WEEX Alpha Awakens, giving the community direct access to top-performing teams and co-presenting sponsor Hubble AI.

- The session enabled participating teams to address community questions and share their experiences in building and operating AI-powered trading strategies under live market conditions.

- This AMA served as a platform for transparent communication and meaningful dialogue, reinforcing WEEX’s ongoing commitment to community engagement and knowledge sharing throughout the hackathon.

In January 2026, an AI trading bot built by a Shanghai-based team outperformed over 90% of human traders during a late-night Bitcoin crash — while its creators slept.

The moment revealed why AI crypto trading is rapidly replacing manual execution. It was just one of the real-world insights shared during WEEX’s $1.88M AI Wars hackathon, where 788 teams deploy autonomous trading systems in live markets. Here are 5 game-changing lessons from the AMA.

Event Overview

As part of the ongoing AI Wars: WEEX Alpha Awakens global AI trading hackathon, WEEX hosted a livestream AMA, bringing together AI infrastructure builders and experienced traders to examine how AI-driven strategies perform in live market conditions. The session featured Leon, Co-Founder & CEO of Hubble AI, alongside competing teams including Chento, Paper Hands Club, and Akash Mondal, who shared firsthand insights on deploying AI systems under real volatility.

The discussion focused on the rise of on-chain AI agents, the limitations of backtesting, the importance of risk management and drawdown control, and whether AI represents a sustainable edge in zero-sum markets. Reflecting the core spirit of the AI hackathon, the AMA emphasized that long-term performance is defined not only by profitability, but by discipline, resilience, and execution quality when strategies are tested in live trading environments.

1 / Why Autonomous AI Agents Are Replacing Human Traders (Hubble CEO’s Prediction)

Leon, CEO and co-founder of Hubble.ai, outlined a long-term vision in which AI becomes the primary interface between traders and financial markets. He noted that the combination of crypto-native infrastructure and AI is accelerating a structural shift: from manual execution to autonomous agents operating continuously on-chain.

This vision is reflected in Hubble AI’s multi-agent architecture, which separates research, portfolio construction, risk management, and execution into distinct components. By mirroring institutional hedge fund workflows, this modular approach enables retail traders to access advanced tools previously reserved for professional trading desks, while allowing each part of a strategy to be evaluated and optimized independently.

2 / AI vs. Human Psychology in Zero-Sum Markets

A recurring theme across the panel was that AI’s immediate edge is psychological, not predictive.

Chento (@chentotrades), a hedge fund co-owner based in the Netherlands, emphasized that most retail trading failures stem from emotional bias rather than flawed strategies. Revenge trading, hesitation, and abandoning stop-loss rules remain structural weaknesses for humans in fast-moving markets.

AI, by contrast, operates without ego, fear, or external pressure — making it better suited to enforce predefined risk parameters consistently.

Chento advocated a hybrid model, where AI handles execution and risk logic, while humans retain strategic oversight during regime shifts.

3 / 24/7 Trading Without Sleep: AI's Secret to Beating Market Volatility

Joakja from Paper Hands Club, representing a Shanghai-based team, highlighted AI’s ability to operate continuously across global time zones without fatigue. His team leverages large language models for signal interpretation while enforcing strict stop-loss rules at the execution layer, enabling consistent performance across varying market conditions.

This setup allows their system to respond to market movements during periods — such as late-night volatility — when manual traders are typically inactive.

According to Joakja, the true value of automation lies in consistency, not speed alone.

4 / Risk Management 2.0: How an Indian Engineer Cut Losses with AI Automation

Akash Mondal, a blockchain engineer and machine learning specialist from India, shared how early drawdowns during the competition prompted him to reaccess his system design.

Rather than optimizing for peak returns, his revised strategy prioritizes maximum drawdown (MDD) control, treating stability as the key indicator of long-term viability.

During the livestream, Akash demonstrated a cloud-based AI agent connected to WEEX via API, capable of analyzing market data and executing trades autonomously in real time — illustrating how risk discipline is enforced at the system level rather than through manual intervention.

5 / The Future of AI Trading: Real-Time On-Chain Data Beats Price Charts

Leon noted that the next generation of AI trading systems will increasingly rely on real-time on-chain data, enabling agents to detect large wallet movements, liquidity shifts, and structural changes before they are reflected in broader market sentiment or price action.

The panel broadly agreed that while fully autonomous trading remains a long-term objective, hybrid models — where AI manages data processing and execution while humans guide high-level strategy — are currently the most effective and practical approach.

Key Takeaway: Why Hybrid AI-Human Models Dominate Trading in 2026

The WEEX AI Trading Hackathon AMA provided insight into how AI trading strategies perform under real market conditions — beyond simulations and pitch decks, and measured directly by live P&L and risk outcomes.

As the competition progresses, WEEX will continue sharing insights drawn from live performance data, contributing to a broader industry dialogue on how AI-driven and autonomous systems are shaping the future of trading.

Want to see these AI strategies in action? Watch the full AMA on YouTube: https://www.youtube.com/watch?v=h3jTwrwYoFk

or track live rankings on WEEX's hackathon leaderboard: https://www.weex.com/events/ai-trading

About WEEX

Founded in 2018, WEEX has developed into a global crypto exchange with over 6.2 million users across more than 150 countries. The platform emphasizes security, liquidity, and usability, providing over 1,200 spot trading pairs and offering up to 400x leverage in crypto futures trading. In addition to traditional spot and derivatives markets, WEEX is expanding rapidly in the AI era — delivering real-time AI news, empowering users with AI trading tools, and exploring innovative trade-to-earn models that make intelligent trading more accessible to everyone. Its 1,000 BTC Protection Fund further strengthens asset safety and transparency, while features such as copy trading and advanced trading tools allow users to follow professional traders and experience a more efficient, intelligent trading journey.

Further Reading

WEEX AI Wars AMA EP1 Recap: How AI Trading Strategies Perform in Live Crypto Markets

You may also like

What is 潜龙勿用 (QLWY) Coin?

潜龙勿用 (QLWY) Coin has recently been listed on WEEX, opening a new avenue for trading on January 27,…

What is Cummingtonite (CUM) Coin?

The Cummingtonite (CUM) coin has made its debut in the crypto market as a meme token, originating from…

What is CLAWDBASE (CLAWD) Coin?

Recently, the cryptocurrency landscape welcomed a new entrant, CLAWDBASE (CLAWD) Coin, a unique community-driven token. Launched on January…

CLAWDBASE USDT World Premiere: clawd.atg.eth Coin Lands on WEEX

WEEX Exchange proudly announces the global exclusive first launch of clawd.atg.eth (CLAWDBASE) Coin, a groundbreaking meme token tied…

潜龙勿用 Coin Price Prediction & Forecasts for January 2026: Could This New Meme Token Surge 50% Post-Launch?

潜龙勿用 Coin just hit the market today, January 27, 2026, as an exclusive premiere on WEEX Exchange, blending…

Cummingtonite (CUM) Coin Price Prediction & Forecast for January 2026: Surging Meme Momentum Ahead?

Cummingtonite (CUM) Coin burst onto the scene today, January 27, 2026, as a fresh Solana-based meme token inspired…

clawd.atg.eth (CLAWDBASE) Coin Price Prediction & Forecasts for January 2026 – Could This Meme Token Surge After Exclusive Launch?

As a seasoned crypto trader who’s been in the game since the early days of Ethereum, I’ve seen…

World Mobile Token (WMTX) Coin Price Prediction & Forecasts for February 2026 – Potential Rebound After Recent 5% Dip?

World Mobile Token (WMTX) Coin has been navigating a tough spot in the crypto market lately, with a…

Capybobo (PYBOBO) Coin Price Prediction & Forecasts for January 2026: Analyzing the 3% Dip and Potential Rebound

Capybobo (PYBOBO) Coin has been turning heads in the GameFi space since its launch, blending art toys with…

Is Boundless (ZKC Coin) a Good Investment? Boundless (ZKC Coin) Price Prediction 2026

For those who have done their research, knowing "how to buy Boundless (ZKC) on weex exchange" is straightforward. WEEX provides a secure gateway.

What Is Sentient (SENT)? The Ultimate Guide to the Decentralized AI Token

For investors convinced by its vision, knowing "how to buy Sentient (SENT) on weex exchange" is straightforward. WEEX provides a secure and regulated platform for accessing the SENT token.

PENGUIN 2026 Price Prediction: Step-by-Step to Buy PENGUIN Crypto

PENGUIN is fundamentally a speculative digital asset built on the Solana network, intentionally devoid of functional utility, a defined development plan, or an economic model designed for revenue generation. Its entire essence and perceived value are constructed from viral online culture, satirical humor, and a veneer of existential or philosophical meme branding, positioning it in stark opposition to projects driven by technological advancement or real-world application.

What is ZERO-HUMAN COMPANY (ZHC) Coin?

In the rapidly evolving world of cryptocurrency, the ZERO-HUMAN COMPANY (ZHC) Coin has made its mark as an…

Moonbirds (BIRB) Coin Price Prediction & Forecasts for January 2026 – Will It Recover from the 15% Dip?

Moonbirds (BIRB) Coin has just hit the crypto scene, launching as an exclusive premiere on January 26, 2026,…

Shrimp Coin Price Prediction & Forecast: Surging 150% Post-Launch in January 2026

Shrimp Coin (SHRIMP) burst onto the scene on January 26, 2026, as an exclusive launch on WEEX Exchange,…

AlphaPride (ALPHA) Coin Price Prediction & Forecasts for January 2026: Potential Rebound After Launch Volatility

AlphaPride (ALPHA) Coin has just hit the crypto scene, launching on January 26, 2026, amid a bustling market…

Exclusive ZHC USDT Pair Trading Live on WEEX Exchange

Exclusive listing alert: ZERO-HUMAN COMPANY (ZHC) Coin is now on WEEX. Read our ZHC USDT spot trading guide and access the AI meme token market securely.

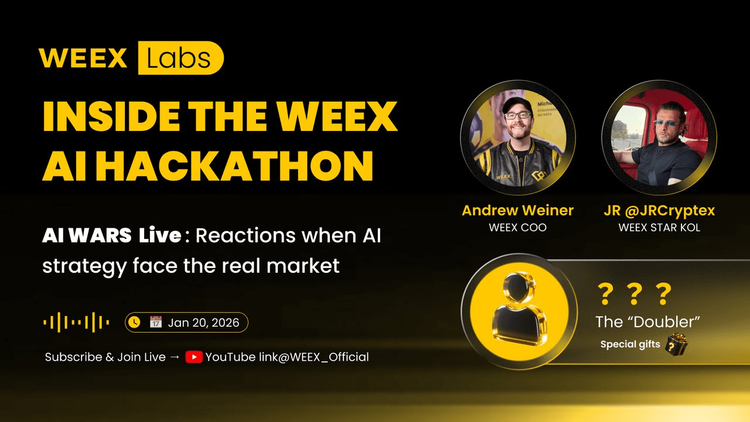

WEEX AI Wars AMA EP1 Recap: How AI Trading Strategies Perform in Live Crypto Markets

What really happens when AI trading strategies move from backtests to live crypto markets? The WEEX AI Wars AMA breaks down real execution, API deployment, risk control, and what crypto traders must get right in cryptocurrency trading.

What is 潜龙勿用 (QLWY) Coin?

潜龙勿用 (QLWY) Coin has recently been listed on WEEX, opening a new avenue for trading on January 27,…

What is Cummingtonite (CUM) Coin?

The Cummingtonite (CUM) coin has made its debut in the crypto market as a meme token, originating from…

What is CLAWDBASE (CLAWD) Coin?

Recently, the cryptocurrency landscape welcomed a new entrant, CLAWDBASE (CLAWD) Coin, a unique community-driven token. Launched on January…

CLAWDBASE USDT World Premiere: clawd.atg.eth Coin Lands on WEEX

WEEX Exchange proudly announces the global exclusive first launch of clawd.atg.eth (CLAWDBASE) Coin, a groundbreaking meme token tied…

潜龙勿用 Coin Price Prediction & Forecasts for January 2026: Could This New Meme Token Surge 50% Post-Launch?

潜龙勿用 Coin just hit the market today, January 27, 2026, as an exclusive premiere on WEEX Exchange, blending…

Cummingtonite (CUM) Coin Price Prediction & Forecast for January 2026: Surging Meme Momentum Ahead?

Cummingtonite (CUM) Coin burst onto the scene today, January 27, 2026, as a fresh Solana-based meme token inspired…